Payroll withholding calculator

For employees withholding is the amount of federal income tax withheld from your paycheck. The amount you earn.

Tax Withholding For Pensions And Social Security Sensible Money

Calculate net payroll amount after payroll taxes federal withholding including Social Security Tax Medicare and state payroll withholding such as State Disability Insurance State Unemployment Insurance and others.

. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. For help with your withholding you may use the Tax Withholding Estimator.

DE 4 Employees Withholding Allowance Certificate. Tax Information Income Tax Withholding Federal Income Tax Withholding on Wages. Starting 2020 there are new requirements for the DE 4.

Things to Keep in Mind with DIY Payroll While these calculators can useful for calculating payroll on your own there are some other things those who want to take the DIY route to doing their payroll. All you have to do is enter your employees gross wages their W-4 withholding information and the cash and credit card tips theyve earned into the calculator and it will tell you what the. Paycheck calculators Payroll tax rates Withholding forms Small business guides.

DE 4S Employees Withholding Allowance Certificate Spanish. Dont want to calculate this by hand. This is a more simplified payroll deductions calculator.

2022 Payroll Tax and Paycheck Calculator for all 50 states and US territories. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. Skip To The Main Content.

Our withholding calculator doesnt ask you to provide personal information such as your name Social Security Number a ddress or bank account information. This number is the gross pay per pay period. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs.

If you work for more than one employer at the same time you must not claim any exemptions with employers other than your principal employer. To change your tax withholding amount. Payroll offices and human resource departments are responsible only for processing the Form OR-W-4.

Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Its important to remember people working in these offices do not know the rest of. We are The Payroll Department for over 700 businesses and organizations in La Plata County Colorado and beyond.

Payroll check calculator is updated for payroll year 2022 and new W4. Ask your employer if they use an automated system to submit Form W-4. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

Weve designed a calculator specifically to tackle tip tax. Online payroll for small business that is simple accurate and affordable. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries.

As employers state agencies and institutions of higher education must deduct federal income tax FIT from wages of a state officer or employeeFIT is computed based on current tax tables and on the designations and exemptions claimed by the employee on his or her W-4 form. Check if you are Non-Resident Alien. We also offer a 2020 version of this calculator.

It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. 2022 Federal State Local Payroll Withholding Calculator Canadian Withholding. You can also use the same tool to calculate hypothetical changes such as withholding more money from each paycheck or increasing your retirement contributions.

The PaycheckCity salary calculator will do the calculating for you. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Submit or give Form W-4 to your employer.

If calculating withholding taxes on tips sounds complicated to you dont worry. 2022 Federal and Illinois Payroll Withholding General Information. Run your first payroll in 10 minutes.

If your spouse is not working or if she or he is. Use this calculator to determine the Total Number of Allowances to enter on your Massachusetts Tax Information in Employee Self-Service. Deduct Federal Income Tax.

Internal Revenue Service Withholding Calculator Identify your tax withholding to make sure you have the right amount of tax withheld. Instead you fill out Steps 2 3 and 4. The biggest tax of.

Another helpful calculator used to determine this is the IRS withholding calculator. For Payroll in Tax Year. The information you give your employer on Form W4.

Pay Periods per Year. All 50 states and multi-state. Free Federal and Illinois Paycheck Withholding Calculator.

Use your estimate to change your tax withholding amount on Form W-4. Instead you fill out Steps 2 3 and 4. The amount of income tax your employer withholds from your regular pay depends on two things.

Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance. SurePayrolls free payroll tax calculator helps small business owners easily calculate payroll taxes for DIY payroll. Fast easy accurate payroll and tax so you save time and money.

Or keep the same amount. Exemption from Withholding. Since 1993 our mission has been to provide you with personal professional confidential and accurate payroll and timekeeping services.

If your employees contribute to 401k HSA FSA or any other pre-tax withholding accounts subtract their contribution from gross wages prior to applying payroll taxes. Online payroll for small business that is simple accurate and affordable. We also offer.

Free Federal and State Paycheck Withholding Calculator. Subtract any deductions and payroll taxes from the gross pay to get net pay.

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

How To Calculate Payroll Taxes Methods Examples More

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

How To Calculate Income Tax In Excel

How To Calculate Federal Income Tax

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate 2019 Federal Income Withhold Manually

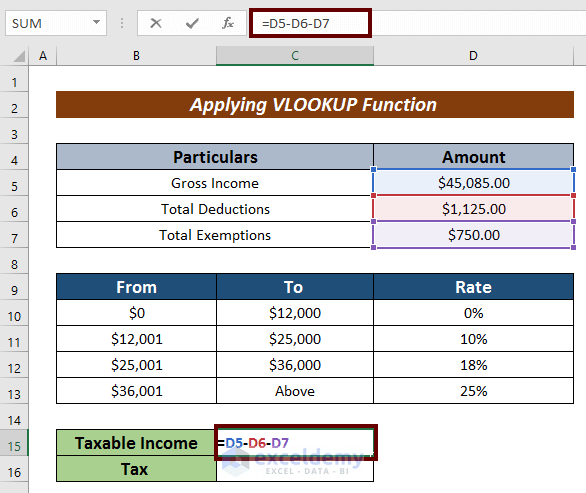

Formula For Calculating Withholding Tax In Excel 4 Effective Variants

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Federal Income Tax Fit Payroll Tax Calculation Youtube

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Paycheck Calculator Take Home Pay Calculator

How To Create An Income Tax Calculator In Excel Youtube

How To Calculate Federal Withholding Tax Youtube